A Complete Guide to Crypto Tax Rates in the United States (2025)

Bitcoin Q4 Outlook: Why The Next Few Months Could Be Bullish

How to do crypto taxes on Coinbase Prime

Andrew DucaAugust 28, 2025

Andrew DucaAugust 28, 2025

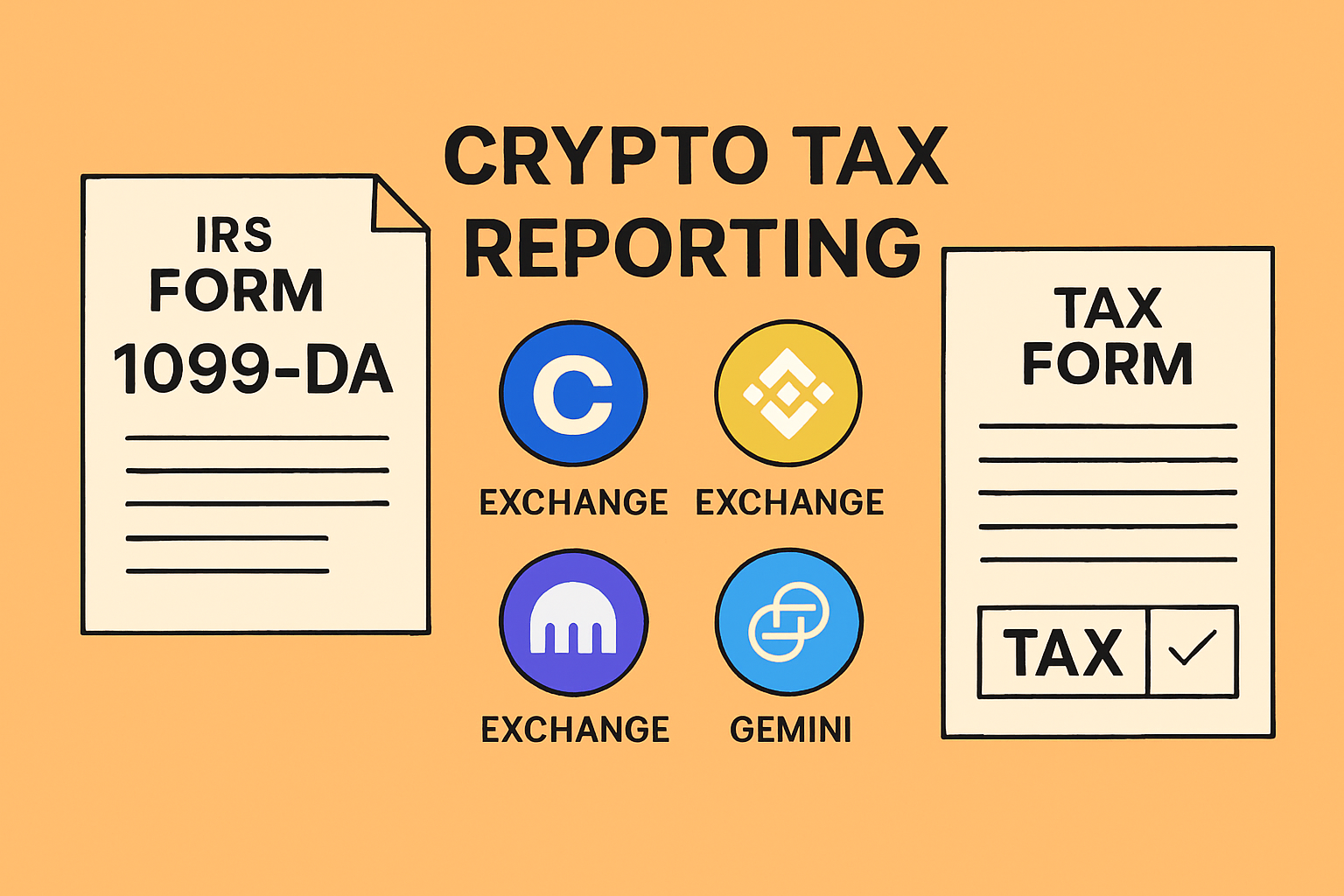

Does Coinbase Report to the IRS? The Big January 2025 Update Explained.

AlexAugust 27, 2025

AlexAugust 27, 2025

Crypto Taxes Simplified—for You and the IRS

Crypto Tax Reporting Just Got Simpler — But the IRS Now Sees More, Too

Need help with your crypto taxes?

Awaken helps 25k+ crypto users do taxes on everything from DeFi to memecoins to LPing.

Get Started

Common U.S. Crypto Tax FAQs: IRS Guidance and Expert Insights (2025)

What Is a Digital Asset? IRS Rules Explained

Best Crypto Tax Software in 2025 | Full Comparison Guide

AlexAugust 22, 2025

AlexAugust 22, 2025

Why Bitcoin Whales Are Rotating Into Ethereum: Market Signals and Tax Implications

Bitcoin Taxes in 2025: A Complete Guide for Investors and Traders

Ethereum Taxes in 2025: Navigating Pectra, DeFi, and Staking Rules

Types of Crypto Strategies for You to Explore

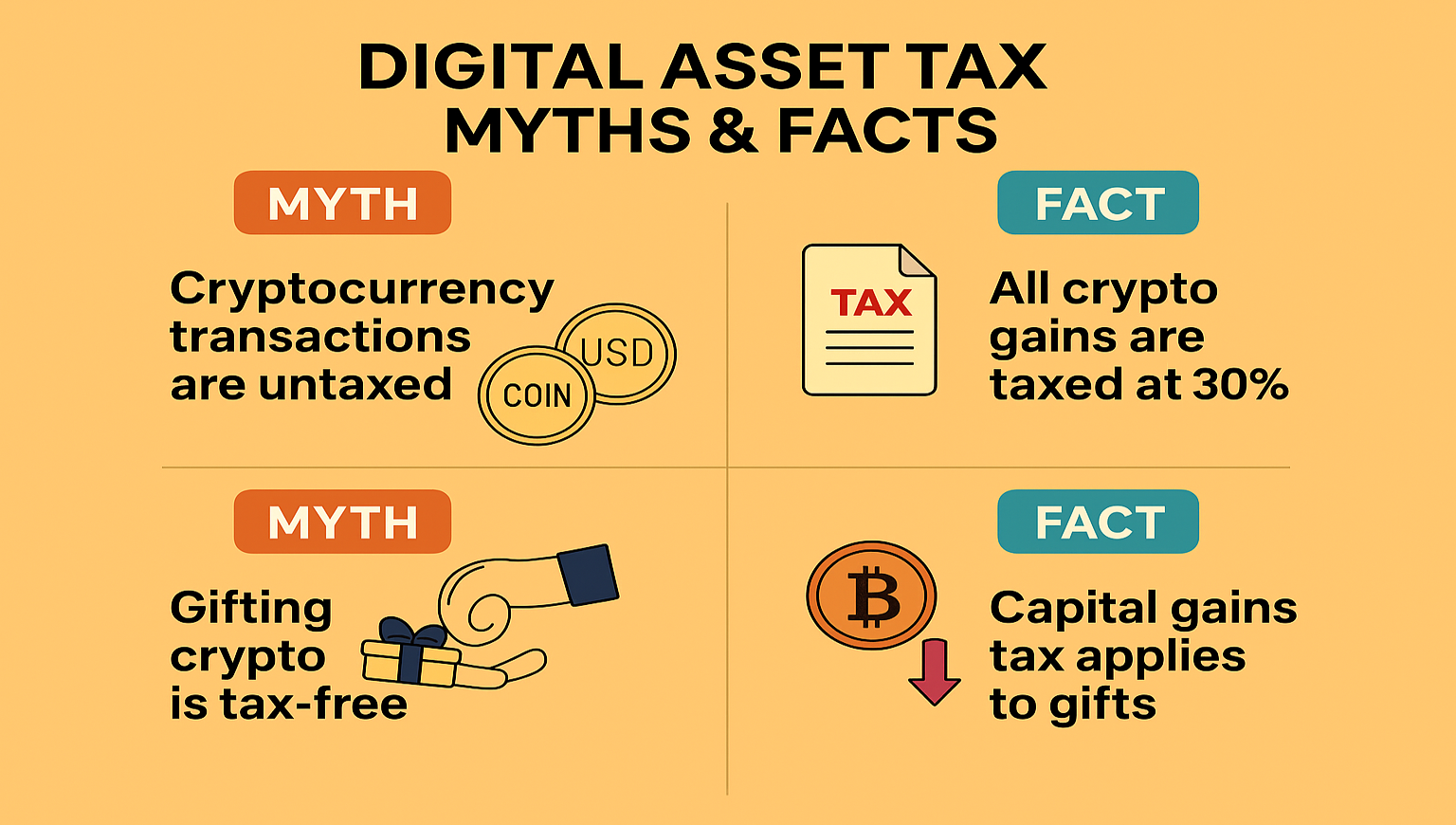

Crypto Tax Myths in 2025: Fact vs. Fiction

Mistakes to Avoid While Reporting Crypto Taxes

Hedera in 2025: A Projected Enterprise Adoption Case Study

Taxes on Stablecoins: A 2025 Guide for Individuals and Businesses

Nansen x Awaken discount codes for Season 2

Andrew DucaAugust 15, 2025

Andrew DucaAugust 15, 2025

Digital Asset Market Clarity Act 2025: What Regulatory Clarity Would Mean for Enterprise Adoption and Tax Planning

Why TokenTax's Tax “Minimization” Is Misleading

Andrew DucaAugust 12, 2025

Andrew DucaAugust 12, 2025

Wash-Sale Rule: Does It Apply to Crypto? Current Law & Future Proposals

Andrew DucaAugust 12, 2025

Andrew DucaAugust 12, 2025

Quarterly Estimated Crypto Taxes: Safe Harbor Rule for Active Traders

Andrew DucaAugust 12, 2025

Andrew DucaAugust 12, 2025

Ethereum vs. The Competition 2025

What Makes Awaken the #1 Crypto Tax Software — And Where We Are Still Improving

Andrew DucaAugust 8, 2025

Andrew DucaAugust 8, 2025

How Russia Taxes Crypto in 2025: Complete Awaken Tax Guide

Andrew DucaJuly 24, 2025

Andrew DucaJuly 24, 2025

Congress Nixes the DeFi-Broker Rule—What That Means for Form 1099-DA

Andrew DucaJuly 10, 2025

Andrew DucaJuly 10, 2025

Why did we make Awaken?

Andrew DucaJuly 4, 2025

Andrew DucaJuly 4, 2025

Big Beautiful Bill Passes—But Crypto Tax Relief Gets Left Behind

Andrew DucaJuly 3, 2025

Andrew DucaJuly 3, 2025

New Lummis Bill Could Make Crypto Purchases Under $300 Tax-Free

Andrew DucaJuly 3, 2025

Andrew DucaJuly 3, 2025

Global Crypto Tax Support: Awaken is Available in 55+ Countries

AlexJuly 2, 2025

AlexJuly 2, 2025

Robinhood Brings Tokenized U.S. Stocks to Europe: What EU Investors Need to Know About Taxes on RWAs

AlexJuly 2, 2025

AlexJuly 2, 2025

Robinhood’s Layer 2 Blockchain and Tokenized Stocks: A New Era for Crypto Investors

AlexJuly 1, 2025

AlexJuly 1, 2025

Puerto Rico Capital Gains Tax: 2025 Guide for U.S. & Island Investors

AlexJune 27, 2025

AlexJune 27, 2025

Is Sending Crypto to Another Wallet Taxable?

AlexJune 27, 2025

AlexJune 27, 2025

How to Import Coinbase Pro to Awaken and Generate Tax Reports

AlexJune 26, 2025

AlexJune 26, 2025

How to Connect Gemini to Awaken and File Your Crypto Taxes

AlexJune 26, 2025

AlexJune 26, 2025

How to Report Taxes For Binance with Awaken Tax

AlexJune 26, 2025

AlexJune 26, 2025

How to Report Binance US Taxes

AlexJune 26, 2025

AlexJune 26, 2025

How to Report Taxes on your Blast Blockchain Transactions

AlexJune 26, 2025

AlexJune 26, 2025

How to Report Taxes for Binance Smart Chain (BSC) With Awaken

AlexJune 26, 2025

AlexJune 26, 2025

How to Report KuCoin Taxes with Awaken

AlexJune 26, 2025

AlexJune 26, 2025

How to Report Magic Eden NFT Taxes with Awaken

AlexJune 26, 2025

AlexJune 26, 2025

Connecting Your Avalanche Wallet to Awaken Tax

AlexJune 19, 2025

AlexJune 19, 2025

Connecting Your Sui Wallet to Awaken and Generating Tax Reports

AlexJune 18, 2025

AlexJune 18, 2025

Reporting Polygon Taxes with Awaken

AlexJune 18, 2025

AlexJune 18, 2025

Doing Your Tangem Wallet Taxes with Awaken

AlexJune 17, 2025

AlexJune 17, 2025

🧩 Connecting Your Ethereum Wallet to Awaken

AlexJune 6, 2025

AlexJune 6, 2025

Exodus Crypto Tax Guide

AlexJune 6, 2025

AlexJune 6, 2025

🧩 Connecting Your Trezor Wallet to Awaken Tax

AlexJune 6, 2025

AlexJune 6, 2025

Kraken Crypto Tax Guide

AlexJune 6, 2025

AlexJune 6, 2025

🧩 Connecting Your Base Wallet to Awaken Tax

AlexJune 5, 2025

AlexJune 5, 2025

How to Report Taxes on your Optimism L2 Transactions

AlexJune 5, 2025

AlexJune 5, 2025

How to Report Taxes on your Arbitrum Transactions

AlexJune 5, 2025

AlexJune 5, 2025

🧩 Connecting Your Ledger Wallet to Awaken Tax

AlexJune 5, 2025

AlexJune 5, 2025

How to Get Your Crypto.com Tax Report & File Taxes

AlexJune 5, 2025

AlexJune 5, 2025

Trust Wallet Tax Guide & IRS Reporting

AlexJune 4, 2025

AlexJune 4, 2025

🧩 Connecting Your Coinbase Account to Awaken Tax

AlexJune 3, 2025

AlexJune 3, 2025

Are Crypto Gas Fees Tax-Deductible?

AlexJune 3, 2025

AlexJune 3, 2025

Coinbase Wallet Tax Guide: How to File Crypto Taxes

Andrew DucaJune 3, 2025

Andrew DucaJune 3, 2025

Can You Gift Crypto Tax-Free?

AlexJune 3, 2025

AlexJune 3, 2025Awaken Security Practices

Andrew DucaJune 3, 2025

Andrew DucaJune 3, 2025

Is Wrapping a Token Taxable? Discussing WBTC, WETH, and Wrapping Transactions

AlexJune 3, 2025

AlexJune 3, 2025

Impermanent Loss: What it is and When You Can Claim a Deduction

AlexJune 2, 2025

AlexJune 2, 2025

NFT Taxes 101: Calculating Profit & Deductible Expenses

AlexJune 2, 2025

AlexJune 2, 2025

Airdrop Taxes 101: How Airdrops are Taxed Around The World

AlexMay 31, 2025

AlexMay 31, 2025

Are Crypto Swaps Taxable? Guide to Token Exchange Tax Rules

AlexMay 31, 2025

AlexMay 31, 2025

FIFO vs. LIFO vs. HIFO: Picking Your Reporting Strategy for Crypto Capital Gains

AlexMay 31, 2025

AlexMay 31, 2025

How to Reduce Crypto Taxes for 2025

Andrew DucaMay 31, 2025

Andrew DucaMay 31, 2025

How to Report Crypto on TurboTax

Andrew DucaMay 31, 2025

Andrew DucaMay 31, 2025

Crypto Taxes 101: How Digital Assets Are Taxed in the U.S.

AlexMay 30, 2025

AlexMay 30, 2025

Global Crypto Tax Landscape 2025: Rules, Rates & Trends in 20+ Countries

AlexMay 30, 2025

AlexMay 30, 2025

Taxes on NFT Royalties: How to Report Creator Revenue on Schedule C

AlexMay 30, 2025

AlexMay 30, 2025

Is Bridging Crypto a Taxable Event? 4 Common Scenarios Explained

AlexMay 29, 2025

AlexMay 29, 2025

Does MetaMask Report to The IRS?

AlexMay 29, 2025

AlexMay 29, 2025

🇿🇦 The Complete Crypto Tax Guide For South Africa in 2025

AlexMay 28, 2025

AlexMay 28, 2025

🇩🇰 The Complete Crypto Tax Guide For Denmark in 2025

AlexMay 28, 2025

AlexMay 28, 2025

🇬🇷 The Complete Crypto Tax Guide For Greece in 2025

AlexMay 28, 2025

AlexMay 28, 2025

🇫🇮 The Complete Crypto Tax Guide For Finland in 2025

AlexMay 28, 2025

AlexMay 28, 2025

🇳🇴 The Complete Crypto Tax Guide for Norway in 2025

AlexMay 25, 2025

AlexMay 25, 2025

🇳🇿 The Complete Crypto Tax Guide For New Zealand in 2025

AlexMay 24, 2025

AlexMay 24, 2025

The Jito Foundation’s Second Legal Analysis of The Taxation LSTs - What Stakers Need to Know

AlexMay 24, 2025

AlexMay 24, 2025

🇨🇭 The Complete Crypto Tax Guide for Switzerland (2025)

AlexMay 23, 2025

AlexMay 23, 2025

🇳🇱 The Complete Crypto Tax Guide for the Netherlands in 2025

AlexMay 22, 2025

AlexMay 22, 2025

🇧🇪 The Complete Crypto Tax Guide for Belgium in 2025

AlexMay 22, 2025

AlexMay 22, 2025

The Complete Crypto Tax Guide for Austria in 2025

AlexMay 21, 2025

AlexMay 21, 2025

Portugal Crypto Tax Guide 2025

AlexMay 20, 2025

AlexMay 20, 2025

Cryptocurrency Tax Guide France 2025

AlexMay 20, 2025

AlexMay 20, 2025

The Complete Crypto Tax Guide for Italy in 2025

AlexMay 19, 2025

AlexMay 19, 2025

Awaken Now Supports Crypto Taxes for Canada!

AlexMay 19, 2025

AlexMay 19, 2025

Crypto Tax Guide Spain

AlexMay 19, 2025

AlexMay 19, 2025

The Complete Crypto Tax Guide for Ireland in 2025

AlexMay 14, 2025

AlexMay 14, 2025

Crypto Tax Guide Australia 2025

AlexMay 14, 2025

AlexMay 14, 2025

Crypto Tax Guide Germany 2025

AlexMay 13, 2025

AlexMay 13, 2025

What is An Aggressive Tax Stance, and Can it Reduce Your Crypto Taxes?

AlexMay 7, 2025

AlexMay 7, 2025

Do You Have to Report Crypto Under $600?

Andrew DucaMay 5, 2025

Andrew DucaMay 5, 2025

What Happens if I Don't File My Crypto Taxes?

Andrew DucaMay 5, 2025

Andrew DucaMay 5, 2025

How to Pay Taxes on Your Hyperliquid Assets

Andrew DucaMay 5, 2025

Andrew DucaMay 5, 2025

MetaMask Tax Reporting Guide

Andrew DucaMay 5, 2025

Andrew DucaMay 5, 2025

How to Reduce Your Crypto Taxes

AlexMay 4, 2025

AlexMay 4, 2025

Bitcoin Taxes in 2025 and Beyond

Andrew DucaMay 4, 2025

Andrew DucaMay 4, 2025

How to Start Trading Memecoins

Andrew DucaMay 4, 2025

Andrew DucaMay 4, 2025

Phantom Wallet Tax Guide

Andrew DucaMay 4, 2025

Andrew DucaMay 4, 2025

How Much Does Hayden Davis Owe In Taxes?

UK Crypto Tax Guide

AlexMay 3, 2025

AlexMay 3, 2025

Trump To Eliminate Crypto Capital Gains Tax: Fact or Fiction?

AlexMay 2, 2025

AlexMay 2, 2025

Solana Crypto Tax Guide: Calculate SOL Taxes

AlexApril 30, 2025

AlexApril 30, 2025

How do crypto taxes work for Canada?

Andrew DucaApril 30, 2025

Andrew DucaApril 30, 2025

Do you need to pay crypto taxes? - A Guide to Crypto Taxes in 2025

Andrew DucaApril 30, 2025

Andrew DucaApril 30, 2025